Are There CRM Tools Built for Accounting Workflows — Practical Tips and Insights

In today’s digital business environment, accountants and financial professionals face increasing pressure to manage client data, track leads, and maintain long-term relationships effectively. Traditional spreadsheets and manual systems no longer suffice. This raises a vital question: Are there CRM tools built for accounting workflows?

The short answer is yes. Specialized CRM tools now cater specifically to accounting workflows, blending client relationship management with financial operations. These systems automate data handling, enhance collaboration, and improve accuracy—allowing accountants to focus on what matters most: serving clients and optimizing their business growth.

In this article, you’ll explore how CRM tools designed for accounting work, their key benefits, top recommendations, and practical tips to implement them effectively.

Understanding the Role of CRM in Accounting Workflows

Customer Relationship Management (CRM) software was originally designed for sales and marketing teams. However, the landscape has evolved. Accounting firms and finance departments are increasingly turning to CRM systems to streamline processes and improve client engagement.

A CRM tool for accounting goes beyond tracking client interactions—it centralizes financial data, automates task management, and simplifies communication between team members and clients.

How CRM Supports Accounting Operations

CRM tools tailored for accounting integrate client data with project management and invoicing. This integration ensures every detail—from tax preparation to payment tracking—is easily accessible. Accountants can set reminders, monitor client status, and generate reports within one platform.

For example, a CRM may automatically link client communication to billing cycles, ensuring no invoice is missed or delayed. This automation saves time, minimizes manual errors, and enhances client trust.

Key Features of CRM Tools for Accounting Workflows

When selecting a CRM system for accounting, it’s essential to identify features that align with your workflow. Not all CRMs are designed with accountants in mind, so focusing on these specialized functions can make a huge difference.

Client Data Management

Accountants handle sensitive client information. A CRM designed for accounting offers secure storage, permission-based access, and encryption to ensure data integrity and compliance with privacy regulations.

Workflow Automation

Automation helps accountants schedule follow-ups, send payment reminders, and update financial reports automatically. It eliminates repetitive manual tasks, reducing workload and human error.

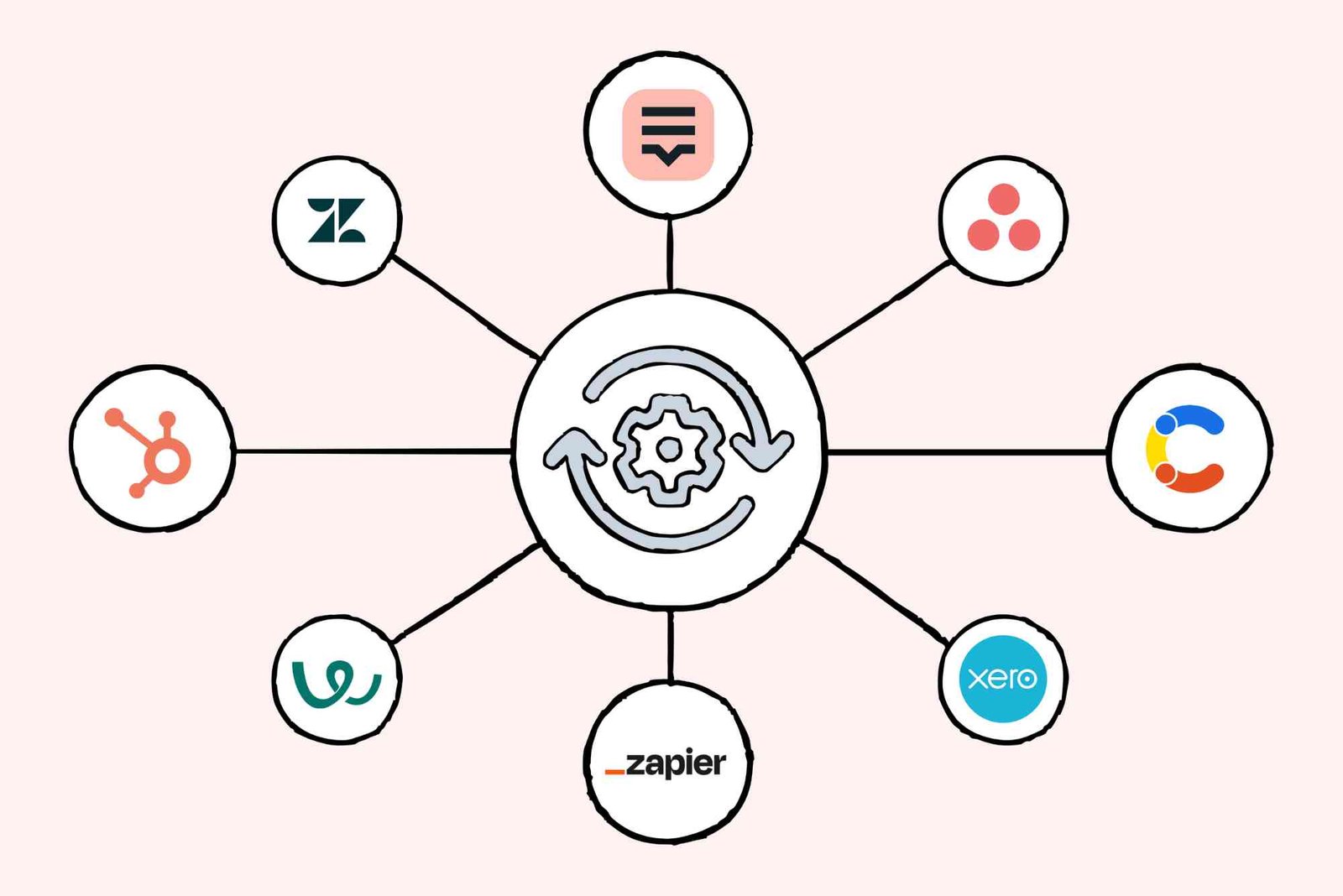

Integration with Accounting Software

Top CRM tools for accounting integrate seamlessly with popular systems like QuickBooks, Xero, or FreshBooks. This allows real-time synchronization of invoices, payments, and financial statements.

Reporting and Analytics

CRMs built for accountants provide analytical dashboards that track client engagement, revenue sources, and workflow performance. These insights help professionals make data-driven decisions.

Collaboration and Task Management

Teams can assign tasks, track progress, and share client notes—all within a single platform. This feature is invaluable for firms managing multiple accountants or bookkeepers.

Are There CRM Tools Built Specifically for Accounting?

Absolutely. In fact, several CRM solutions are tailored exclusively for accountants and financial service providers. If you’ve ever wondered Are There CRM tools that truly fit the accounting model, the answer lies in specialized platforms designed to handle both relationship and financial data simultaneously.

Examples of CRM Tools for Accounting Workflows

- Zoho CRM for Finance – Zoho provides industry-specific templates, integration with Zoho Books, and automation features ideal for accountants.

- HubSpot CRM – Known for its flexibility, HubSpot can be customized with accounting integrations and offers excellent analytics and workflow management. Read more on www.hubspot.com

- Financial Cents – Built specifically for accounting firms, it helps manage client projects, automate reminders, and track document submissions.

- QuickBooks CRM Integration via Method:CRM – This tool bridges CRM and accounting by directly linking client relationship management with QuickBooks’ financial system.

These platforms simplify how accountants communicate with clients, manage leads, and monitor deadlines.

To explore an in-depth discussion about this topic, visit Are There CRM Tools.

Benefits of Using CRM Tools in Accounting

Implementing a CRM tool can revolutionize your accounting operations. Let’s look at some transformative advantages.

Enhanced Client Communication

A CRM provides a single point of contact for all client information. Accountants can quickly access communication history, payment records, and project notes, enabling personalized service and faster response times.

Improved Accuracy and Compliance

Automation minimizes manual entry errors and ensures data accuracy. With built-in audit trails, accountants can maintain compliance with financial reporting standards.

Increased Productivity

CRM tools eliminate time wasted on repetitive tasks. Automated workflows free accountants to focus on advisory services, client acquisition, and strategy development.

Real-Time Data Insights

Dashboards provide instant visibility into client activity, outstanding invoices, and performance metrics, allowing teams to make proactive decisions.

Scalable Business Operations

As your accounting firm grows, CRM systems scale with you. Whether managing ten clients or a thousand, a well-structured CRM supports consistent service delivery.

Practical Tips for Implementing CRM in Accounting

To fully leverage CRM for accounting workflows, strategic implementation is key. Here are proven strategies to ensure success.

Choose the Right CRM for Your Workflow

Start by identifying your firm’s pain points. Do you struggle with client communication, missed deadlines, or data management? Select a CRM that addresses these issues directly.

Integrate with Existing Accounting Software

Avoid working in silos. Integrate your CRM with your accounting tools to ensure seamless data flow. This integration reduces duplication and enhances accuracy.

Train Your Team

Even the best CRM is ineffective without proper user adoption. Conduct hands-on training sessions to ensure everyone understands the tool’s features and benefits.

Customize Dashboards and Reports

Tailor your CRM to display relevant metrics—like client profitability, overdue invoices, or engagement levels. Customized dashboards make insights actionable.

Automate Repetitive Tasks

Use automation for routine activities like sending payment reminders or scheduling tax season alerts. This saves time and reduces oversight.

Prioritize Data Security

Since accounting involves sensitive financial data, ensure your CRM provider complies with industry-grade security standards, including encryption and secure authentication.

For further guidance and expert insights, explore Are There CRM.

Common Challenges When Using CRM for Accounting

While CRM tools offer numerous benefits, implementation challenges may arise. Understanding these early helps avoid setbacks.

Resistance to Change

Accountants accustomed to traditional spreadsheets may resist adopting new systems. Clear communication and training can ease this transition.

Data Migration Issues

Transferring existing data into a new CRM can be complex. Always back up records and verify data accuracy after migration.

Over-Customization

Too many custom fields can overcomplicate workflows. Focus on essential features that truly enhance your operations.

Cost Management

Some CRMs can become expensive with premium features. Evaluate ROI by measuring time saved and client satisfaction improvements.

FAQs

What is a CRM tool in accounting?

A CRM tool in accounting helps manage client relationships, automate workflows, and integrate financial data to improve efficiency and accuracy.

Are CRMs necessary for small accounting firms?

Yes. Even small firms benefit from centralized data, improved communication, and streamlined operations.

Can a CRM integrate with QuickBooks or Xero?

Most modern CRMs integrate with popular accounting software, enabling synchronized billing, invoicing, and payment data.

How much do CRM tools for accountants cost?

Pricing varies based on features and users. Entry-level options may start as low as $20 per user per month, while advanced solutions cost more.

What’s the best CRM for accountants?

HubSpot, Zoho, Financial Cents, and Method:CRM are top-rated for accounting workflows. Each offers unique features suited for different firm sizes.

The question “Are there CRM tools built for accounting workflows?” is no longer up for debate—there are, and they are transforming the accounting industry. From enhanced client management to seamless software integration, CRM solutions streamline every part of your business operations.

By choosing the right CRM, integrating it effectively, and training your team, you can elevate your firm’s efficiency, accuracy, and client satisfaction.

If you’re ready to explore expert recommendations and actionable insights, visit Are There CRM Tools today and start transforming your accounting workflow.